By Lovlyn

Money can be a major source of stress. When bills keep piling up, unexpected expenses pop up, and your income just isn’t stretching enough, it’s easy to feel overwhelmed. Financial stress doesn’t just affect your wallet; it can take a serious toll on your mental health.

If you’ve ever found yourself constantly worrying about how to make ends meet, feeling anxious about debt, or losing sleep over money, you’re not alone. Millions of people experience financial struggles every day. The important thing is learning how to protect your mental well-being even when your finances are tight.

In this post, we’ll talk about why financial stress affects your mental health and what you can do to cope better based on real, practical steps you can start today.

Why Financial Stress Affects Your Mental Health

When you’re constantly worried about money, it’s not just about the lack of it; it’s about what it represents.

Security. Stability. Options. Freedom.

It’s completely normal to feel frustrated or anxious when your finances aren’t in a good place. Society often makes it seem like money is the answer to every problem and when you don’t have enough, it can feel like your problems are endless.

Think about it: rent is due, school fees are waiting, food prices are rising, transportation costs keep increasing, and emergencies happen out of nowhere. These are real, everyday challenges that can easily lead to stress, worry, or even hopelessness.

Financial pressure can cause:

- Trouble sleeping

- Difficulty focusing

- Mood swings or irritability

- Feelings of shame or failure

- Withdrawal from social activities

But here’s something to remember: feeling stressed about money doesn’t make you weak, it makes you human with human problems. And the good news is, there are practical ways to regain control and protect your mental health, even when your finances are not where you want them to be.

1. Assess Your Financial Situation Honestly

The first step to reducing financial stress is understanding your current situation. You can’t fix what you don’t fully know.

Start by tracking where your money goes. Whether you earn a salary, run a small business, or depend on irregular income, make a list of what comes in and what goes out. Write down every expense, no matter how small.

When you do this, you might realize how much you’re spending on things that don’t really matter, and you’ll see areas where you can make small adjustments. This process creates clarity and control, which are key to reducing stress.

You can use a simple notebook, your phone, or a financial stress relief worksheet to stay organized. By seeing your numbers clearly, you’ll begin to make more mindful financial decisions and that awareness alone can ease anxiety.

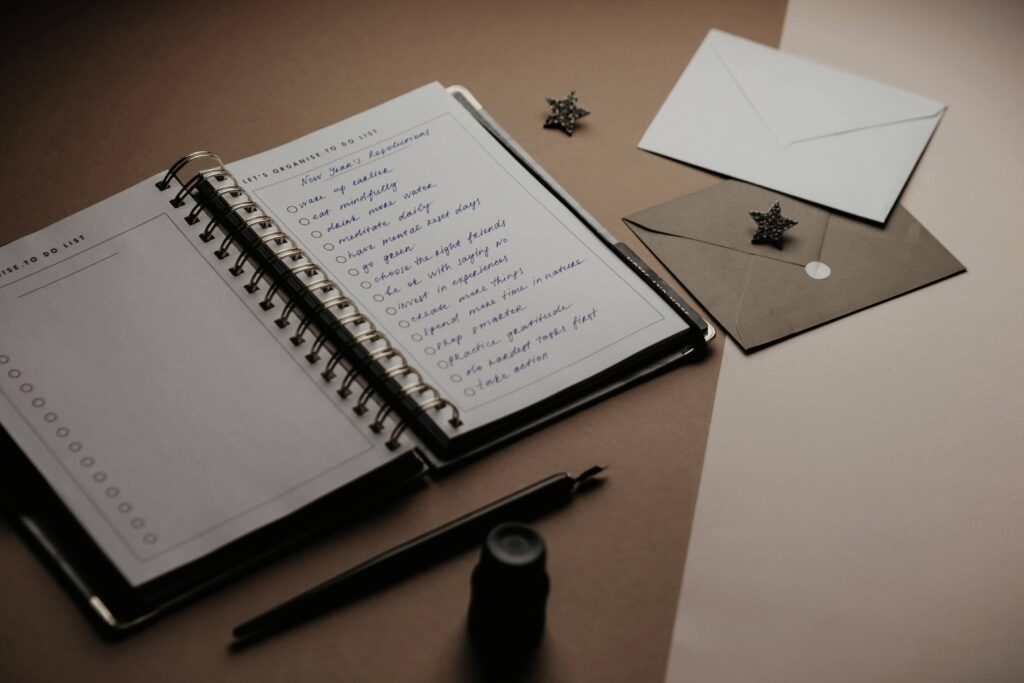

2. Set Small, Achievable Financial Goals

Once you know where your money is going, the next step is setting realistic goals. It’s not enough to simply hope things will get better, you need a plan.

Start with small, achievable goals that don’t feel overwhelming. For example:

- Save ₦1000 or $15 weekly.

- Pay off one small debt before tackling a bigger one.

- Cut down on a non-essential expense, like daily takeout or streaming subscriptions.

Every small win matters. It gives you a sense of control and progress, both of which are powerful for your mental health.

You don’t have to do everything at once, just stay consistent. When you hit a small goal, celebrate it. Those little moments of success can boost your confidence and motivation to keep going.

Remember: this isn’t about perfection. It’s about direction.

3. Protect Your Mental Health While Managing Your Finances

Money is important, but it isn’t everything. Even when finances are tight, you can still nurture your mental well-being.

Here are some simple, low-cost ways to protect your mental health:

- Take a walk to clear your mind.

- Pray to find peace and perspective.

- Listen to music that uplifts your spirit.

- Spend time with loved ones who make you feel supported.

- Eat healthy meals, even on a budget.

And here’s something to think about: if you believe eating healthy is expensive, try paying hospital bills. It’s often better to invest in prevention through good food and rest than deal with illness later.

When you take care of your mind and body, you’re in a better position to handle challenges and make sound financial decisions.

A Final Word

If your financial situation is affecting your mental health, know that things can get better. Hard times don’t last forever. Every small step you take, whether it’s tracking your spending, setting a goal, or choosing to rest instead of worrying, moves you closer to peace and stability.

You have the power to change your financial situation, even if it takes time. Be patient with yourself, stay consistent, and remember that your mental health matters just as much as your money.

Need a Little Extra Help?

You can download our free Financial Stress Relief Tracker to help you monitor your spending, manage your stress, and stay on top of your goals.

And if you’d like personal support, consider booking a one-on-one session with a mental health coach who can guide you in balancing your financial goals with emotional well-being.

If you found this post helpful, share it with someone who might need it today.